Historical Developments:

The Electronics Industry in India took off around 1965 with an orientation towards space

and defence technologies. This was rigidly controlled and initiated by the government. This

was followed by developments in consumer electronics mainly with transistor radios, Black

& White TV, Calculators and other audio products. Colour Televisions soon followed. In

1982-a significant year in the history of television in India - the government allowed

thousands of colour TV sets to be imported into the country to coincide with the broadcast

of Asian Games in New Delhi. 1985 saw the advent of Computers and Telephone

exchanges, which were succeeded by Digital Exchanges in 1988. The period between 1984

and 1990 was the golden period for electronics during which the industry witnessed

continuous and rapid growth.

From 1991 onwards, there was first an economic crises triggered by the Gulf War which was

followed by political and economic uncertainties within the country. Pressure on the

electronics industry remained though growth and developments have continued with

digitalisation in all sectors, and more recently the trend towards convergence of technologies.

After the software boom in mid 1990s India's focus shifted to software. While the hardware

sector was treated with indifference by successive governments. Moreover the steep fall in

custom tariffs made the hardware sector suddenly vulnerable to international competition. In

1997 the ITA agreement was signed at the WTO where India committed itself to total

elimination of all customs duties on IT hardware by 2005. In the subsequent years, a number

of companies turned sick and had to be closed down. At the same time companies like

Moser Baer, Samtel Colour, Celetronix etc. have made a mark globally.

Current Scenario:

In recent years the electronic industry is growing at a brisk pace. It is currently worth US$ 32

Billion and according to industry estimates it has the potential to reach US$ 150 billion by

2010. The largest segment is the consumer electronics segment. While is largest export

segment is of components.

The electronic industry in India constitutes just 0.7 per cent of the global electronic industry.

Hence it is miniscule by international comparison. However the demand in the Indian

market is growing rapidly and investments are flowing in to augment manufacturing capacity.

The output of the Electronic Hardware Industry in India is worth US$11.6 Billion at present.

India is also an exporter of a vast range of electronic components and products for the

following segments

• Display technologies

• Entertainment electronics

• Optical Storage devices

• Passive components

• Electromechanical components

Corporate Catalyst India A report on Indian Electronics Industry

• Telecom equipment

• Transmission & Signaling equipment

• Semiconductor designing

• Electronic Manufacturing Services (EMS)

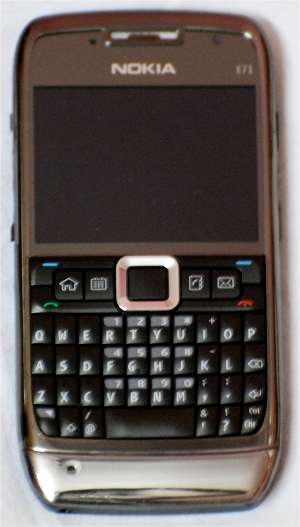

This growth has attracted global players to India and leaders like Solectron, Flextronics, Jabil,

Nokia, Elcoteq and many more have made large investments to access the Indian market. In

consumer electronics Korean companies such as LG and Samsung have made commitments

by establishing large manufacturing facilities and now enjoy a significant share in the growing

market for products such as Televisions, CD/DVD Players, Audio equipment and other

entertainment products.

The growth in telecom products demand has been breathtaking and India is adding 2 million

mobile phone users every month! With telecom penetration of around 10 per cent, this

growth is expected to continue at least over the next decade. Penetration levels in other high

growth products are equally high and growth in demand for Computer/ IT products, auto

electronics, medical, industrial, as well as consumer electronics is equally brisk. Combined

with low penetration levels and the Indian economy growing at an impressive 7 per cent per

annum, the projection of a US$150 Billion+ market is quite realistic and offers an excellent

opportunity to electronics players worldwide.

Electronic Manufacturing Services:

India is well-known for its software prowess. But on the hardware front, the progress is

rather slow. However, the country has been making gains in this sector also. Already, 50

Electronics Manufacturing Services (EMS)/Original Design Manufacturers (ODMs)

providers are operating in India, ranging from global players including Flextronics and

Solectron to indigenous firms including Deltron, TVS Electronics and Sahasra. Further

moves by international players are expected to add production in India in the coming years.

India’s contract-manufacturing business is expected to nearly triple in revenue over the next

five years, a development that will present both opportunities and potential pitfalls for the

worldwide electronics supply chain. Revenue generated by Electronics Manufacturing

Services (EMS) providers and Original Design Manufacturers (ODMs) in India will expand

to $2.03 billion in 2009, rising at a CAGR of 21 per cent from $774 million in 2004. Indian

EMS/ODM revenue grew by 20.8 per cent to reach $935 million in 2005.

Obvious allure of locating electronics production in India is the nation’s low labor costs.

Labor costs for conducting electronics manufacturing in India are between 30 to 40 per cent

less than in the United States or in Western Europe. Other equally important benefits from

operating in India include a fast-growing domestic market, an excellent education system, the

nation’s technology parks and the recent improvements in the country’s transit and utility

infrastructure.

However, the Indian contract-manufacturing industry is not expected to pose a significant

threat to China’s position as the epicenter of electronics manufacturing in the short term.

India’s contract manufacturing activities primarily serve the nation’s indigenous demand.

Corporate Catalyst India A report on Indian Electronics Industry

OEMs primarily outsource manufacturing to cater to the Indian domestic market, although

export of Indian-assembled electronic goods does occur. In the longer term, i.e. 2009

onward, it is predicted that India may compete with the Chinese providers in select products

as the nation’s share of the global electronics market increases.

For OEMs, using contract manufacturing services in India can help them penetrate the local

market. However, OEMs face specific risks associated with using contract manufacturers in

India. Fluid exchange rates combined with volatile oil and component prices lead to

unpredictable costs. Changing government policies along with shifting government regimes

also contribute to an unpredictable political environment. Doing business in India is often

disjointed, with an inefficient bureaucratic system that causes frequent delays. However, for

OEMs able to manage these risks, the opportunity in India is significant.

The semiconductor fabrication segment has a small existing base in India with only two

fabrication units, which both are developing chips for the defense and strategic sectors.

However, semiconductor suppliers are expanding their manufacturing activities in India to

serve the growing contract-manufacturing industry in the nation. As evidence of this trend,

groundbreaking commenced on a 200 mm fabrication unit in Hyderabad operated by Nano-

Tech Silicon India Ltd.

The Growth Drivers:

Behind the impressive growth of the electronics industry is the robust and consistent growth

in Electronic Hardware market of approximately 25 per cent due to a stable economy &

large middle class of 350 million people. The fastest growing segments are demand for

telecom services particularly cell phones, internet subscribers & growth in demand for it

products with increasing penetration of computers, falling prices & Government support to

rapidly encourage usage of IT in all sectors. Within next 5 years penetration of telephone

users (both landline & mobile) is projected to increase from 100 to 500 per thousand while

PC's increase from 10 to 30 plus per thousand. Some of the other factors are

• Highly talented workforce, especially for design and engineering services with good

communication skills.

• Rising labor costs in China.

• Presence of global Electronics Manufacturing Services (EMS) majors in India and their

plans for increased investments in India.

• More outsourcing of manufacturing by both Indian and global Original Equipment

Manufacturers

Production Trend of Different Segments:

1) Consumer Electronics

Consumer electronics (durables) sector continues to be the main stay of the Indian electronic

industry contributing about 32 per cent of the total electronic hardware production. By the

end of 2005-06, the market for consumer durables (including entertainment electronics,

communitarian and IT products) was Rs 180 billion (US $4.5 billion). The market is

expected to grow at 10 to 12 per cent annually and is expected to reach Rs 60 billion

(US$13.3 billion) by 2008. The urban consumer durables market is growing at an annual rate

Corporate Catalyst India A report on Indian Electronics Industry

of seven to 10 per cent, the rural durables market is growing at 25 per cent annually. Some

high-growth categories within this segment include mobile phones, TVs and music systems.

2) Computer Industry

With sound macroeconomic condition and buoyant buying sentiment in the market, PC

sales touched 6.5 million units during 2006-07. The high growth in PC sales is attributed to

increased consumption by Industry verticals such as Telecom, Banking and Financial

Services, Manufacturing, Education, Retail and BPO/IT-enabled services as well as major e-

Governance initiatives of the Central and State Governments. Significant consumption in

the small and medium enterprises and increased PC purchase in smaller towns and cities was

witnessed during the year. It is expected that increased Government focus on pan-India

deployment of broadband at one of the lowest costs in the world will soon lead to

accelerated PC consumption in the home market.

The growing domestic IT market has now given impetus to manufacturing in India. The year

witnessed not only capacity expansion by the existing players, but also newer investments in

hardware manufacturing. India is also high on the agenda of electronics manufacturing

services companies.

3) Control, Instrumentation and Industrial Sector

This is now a matured industry sector in the country at least as far as various application

segments is concerned. State-of-art and reliable SCADA, PLC/Data Acquisition systems are

being applied across various sections of the process industry. Latest AC drive systems from

smaller to very high power levels also find application in large engineering industries like

steel plants and/or metal industries. World class UPS systems are being manufactured in the

country to cater to the need of the emerging digital economy. However, it appears there is

really no manufacturing base in the country for the whole range of the latest test and

measuring instruments which are invariably procured from outside. A good number of

Indian companies in the control and instrumentation sector are able to acquire orders for

export systems through international competitive bidding.

However, the creation of knowledge base in the country through industrial R&D in this

critical sector has not been improving as desired. There is still lack of needed R&D activities

by the industry looking at the global market. On the part of Department of Information

Technology some of the latest technology development and applications in this area include

Intelligent SCADA Systems for monitoring and control of Mini Hydel plants, Advanced

Traffic Control System for urban transportation, Intelligent Power Controllers for

improvement of quality of electric power, etc. These systems have been successfully

developed and applied in real field conditions.

4) Communication & Broadcasting Sector

The telecommunication industry has gained tremendous recognition as the key driver for all

round development and growth. With about 256 million telephone subscribers (as on

Corporate Catalyst India A report on Indian Electronics Industry

February, 2007) India has emerged as one of the largest in the world and second largest in

Asia.

The share of private sector in telecom industry has increased to more than 57 per cent and

the contribution of mobile telephony has gone upto 63 per cent on December, 2007. Buoyed

by the better-than-expected teledensity in 2005 (11.4 per cent against 8.6 per cent in 2004)

due to the mobile boom in India, Department of Telecommunications (DoT) has revised the

upwards the target of 22 per cent teledensity by 2007.

Broadband connectivity is holding tremendous potential in the country. It is expected that

the number of broadband subscribers would reach 20 million by 2010.

India has emerged as the second largest market for mobile handsets. Following the

unprecedented growth in the mobile market, a number of companies are planning to set up

production base for mobile hand sets in the country for meeting local as well as export

markets.

Direct to Home (DTH) broadcast service has gained more and more popularity during 2005.

DTH service is available through National Broadcaster and private DTH service provider.

Better quality digital broadcast reception is now available almost everywhere in the country

to the common people on their TV sets through the use of small dish antenna and a Set-Top

Box (STB).

5) Strategic Electronics

Though the government has started the process of getting private sector involved in the

production of strategic electronics equipments, the private involvement is at its nascent

stage. The estimated market for strategic electronics in India during 2005-06 was Rs.32

billion and 95 per cent of this was done by the public sector unit Bharat Electronics Limited

(BEL).

6) Electronic Components

The total production of components was estimated at Rs. 88 billion during 2005-06. The

colour picture tube production is likely to be around 11 million, a decline from 11.2 million

in the last year. The production of B&W picture tubes declined further due to decreased

market for B&W TVs.

The components with major share in the export are CD-R, CPTs, PCBs, DVD-R,

connectors, semiconductor devices, ferrites, resistors, etc.

Significant developments took place during the year in the area of colour picture tubes and

colour glass parts. Another CPT manufacturer successfully launched manufacture of pure

flat tubes, leading to availability of flat tubes from three indigenous sources. The CPT units

continued expansion of capacities to improve further their global competitiveness. Two

more lines were commissioned during the year, one for manufacture of large size flat colour

Corporate Catalyst India A report on Indian Electronics Industry

picture tubes and the second for small size. Two more lines are likely to come up next year.

Keeping pace with the downward trend in prices of color TVs, the prices of CPTs also fell.